FDIC Put Insurance coverage Limits For every Family savings 1934 2022

Blogs

Beginning profile from the additional branches of the identical lender won’t increase your insurance coverage. Some creditors offer prolonged FDIC insurance coverage thanks to their particular partner financial sites. For example, SoFi Lender brings as much as $step three million inside the security by automatically posting deposits around the their community from mate banks. IntraFi Dollars Services (ICS) and you may Certification from Deposit Account Registry Services (CDARS) is points given thanks to IntraFi, which includes a system out of banking companies you to bequeath your finances around the multiple financial institutions to ensure you’lso are effectively shielded. This service works with examining profile, money market profile and you may Dvds. If you want to pass on your finances to grow your FDIC exposure, lender systems give a way to do it as opposed to financial institutions controlling multiple account yourself.

- If you are borrowing unions aren’t included in FDIC insurance rates protections, he is nonetheless secure.

- A property manager can keep the deposit currency for rent for many who moved aside instead of giving best written see.

- Use the made pub code to help you an actual physical location which have PayNearMe characteristics such Members of the family Buck or 7-Eleven.

- A good investment from the money isn’t insured or guaranteed by the the fresh Federal Deposit Insurance Business and other government department.

it Local casino – Best Bitcoin step one Buck Deposit Casino Bonus

When you sign up Fortune Coins, the new Gold Coin bundles try open for purchase. The tiniest offer costs $5 and supply your one million Coins and 515 Fortune Coins. That is a really a purchase price and you can contributes quite a bit from coinage to your account. As opposed to the other Social Gambling enterprises you’ll learn about on this page, Risk.all of us Casino just accepts cryptocurrency as a method out of fee. Several types of cryptocurrency try approved, although not, which means you’ll features a lot of choices available if you have a crypto bag. Stake.united states Casino has multiple Gold Money bundles available.

So it really does require some research earliest to obtain the right bank. Including, if you’re looking for deals account, you’d should examine interest rates and you may fees from the some other banking institutions. On the web banking companies usually offer high APYs to savers minimizing fees, than the conventional brick-and-mortar banking companies. Once you are a member out of LuckyLand Harbors, you can make SCs and you will Coins each day because of the signing in the. Put also big quantities of virtual currency because of the searching for to buy a gold Coin plan.

As to why Limelight Bank?

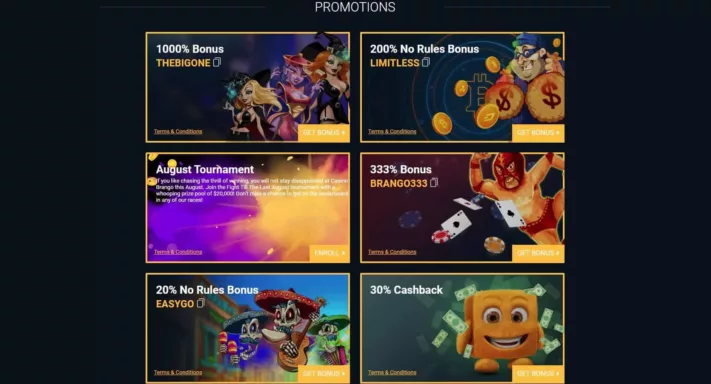

Not only can you appreciate Western european Roulette, but some other designs and you will distinctions too. There’s zero limit to your readily available incentives in the $step one casinos as https://happy-gambler.com/dragon-king/ they likewise have totally free spins on the most recent video game, suits bonuses that have sophisticated terms and conditions. Also, you can even predict advanced advantages away from respect software, VIP membership and! It all depends on the $step 1 gambling establishment you choose because they all the focus on additional pro wishes.

The fresh 2008 increase try the original as the Higher Despair to help you take place in reaction to a serious economic disaster. Congress very first meant it so you can past merely so long as the fresh threat of extensive lender disappointments, but you to wasn’t to be. The brand new Dodd-Honest Work out of 2010, a banking reform and you will individual defense bundle enacted to help you avoid a great recite of one’s GFC, generated the fresh $250,100 limit permanent. Congress didn’t should allow the newly created FDIC a blank consider or remind irresponsible conclusion, so it set strict constraints on the number secure.

Some associations have started giving around $step three million away from FDIC insurance rates.

- Important info on the steps to own opening another account.

- To have reason for that it paragraph “regular play with otherwise local rental” mode have fun with or local rental to own an expression of only 125 consecutive days for home-based objectives by the a guy having a long lasting host to household somewhere else.

- For individuals who’re given starting a card partnership membership, treat it in the same way you would a checking account.

- Fortunately, the newest FDIC wandered inside and you will made sure you to whether or not a lot of bank team forgotten the perform, no depositors missing people insured money.

- Their statements, deposit slides, and you will terminated monitors aren’t sensed deposit account facts.

- This means evaluating the brand new charges you could shell out plus the focus you might earn, and also other have including on the internet and mobile banking accessibility or even the size of the Automatic teller machine network.

Money You to Lender isn’t accountable for people injuries or liabilities through the end of an account relationship. Susceptible to one rights we may has regarding improve find of withdrawal from your own membership, you can even romantic your account when and any cause. Should your membership is actually overdrawn whenever we personal they, you invest in on time pay-all quantity due to help you all of us. The brand new FDIC contributes along with her all the places inside retirement membership listed above owned by a similar people in one insured financial and you will makes sure extent to all in all, $250,100000. Beneficiaries will be entitled throughout these membership, but that doesn’t add more the new deposit insurance policies coverage.

If you withdraw away from a Computer game earlier matures, the fresh penalty can be equivalent to the level of desire earned while in the a particular time. As an example, a bank will get impose a penalty of ninety days away from easy attention on the a single-seasons Computer game if you withdraw out of one to Cd until the year try up. Because the specific steps can differ by Atm host and you may financial, of many go after the same buy from functions. Let’s walk-through a few of the rules of the bucks put and look at particular factors to keep in mind with each other the way.

We’ve used the robust 23-step opinion way to 2000+ gambling enterprise recommendations and you can 5000+ added bonus now offers, making certain i identify the newest safest, safest systems having actual added bonus value. There are even AGCO signed up and you may managed $step one min deposit gambling enterprises to have Ontario in the 2025 and you will all of our dedicated web page to own Ontario have everything people will demand as well as a listing of the big ten Ontario gambling enterprises where you are able to wager merely a dollar. Many reasons exist anyone favor a casino which have a 1 buck minimal put.

The retailer get consult a good preauthorization to your purchase. If you demand me to look and you can/or reproduce many facts (statements, checks, places, withdrawals, etcetera.) we might cost you, therefore agree to spend it commission. In case your expected payment are highest, you might be asked to expend the fee ahead of time.

Much more online casino info

Vanguard Government Currency Industry Finance is actually a common fund that can qualify for SIPC shelter. Although not, because they’re also different varieties of points, the cash they give can be other. For further considerations, make reference to the newest Innovative Bank Sweep Items Terms of use (PDF). Thankfully that you wear’t have to exposure which have uninsured places. Banking companies and credit unions render multiple ways to structure your own profile to ensure all of your money is safe. The fresh FDIC visibility try $250,100000 total for all single membership belonging to the same individual in one insured financial.

Because of the installing numerous beneficiaries for your membership, you could increase your FDIC coverage in order to $step one.25 million altogether. Along with, take time to review your bank account stability as well as the FDIC laws you to definitely pertain. This could be especially important just in case there has been a huge change in your daily life, such as, a passing on the members of the family, a separation and divorce, otherwise an enormous put out of your home product sales. Any of those incidents you may set some of your finances more the newest federal restrict. When you establish a revocable believe membership, you generally signify the money have a tendency to citation in order to called beneficiaries on the demise. I’ve already been a personal financing blogger and editor for more than 2 decades devoted to currency administration, put profile, spending, fintech and you will cryptocurrency.